The assessor must annually assess all taxable property in the county to the person, business, or legal entity owning, claiming, possessing, or controlling. Under the california constitution and the revenue and taxation code, the assessor has the following responsibilities: Locate all taxable property within ventura county identify the person who owns, claims, possesses, or controls property on the lien date (r&t § 405). You may also contact us by email. The ventura county assessor’s office is committed to helping homeowners understand their rights and the process of valuation for their property.

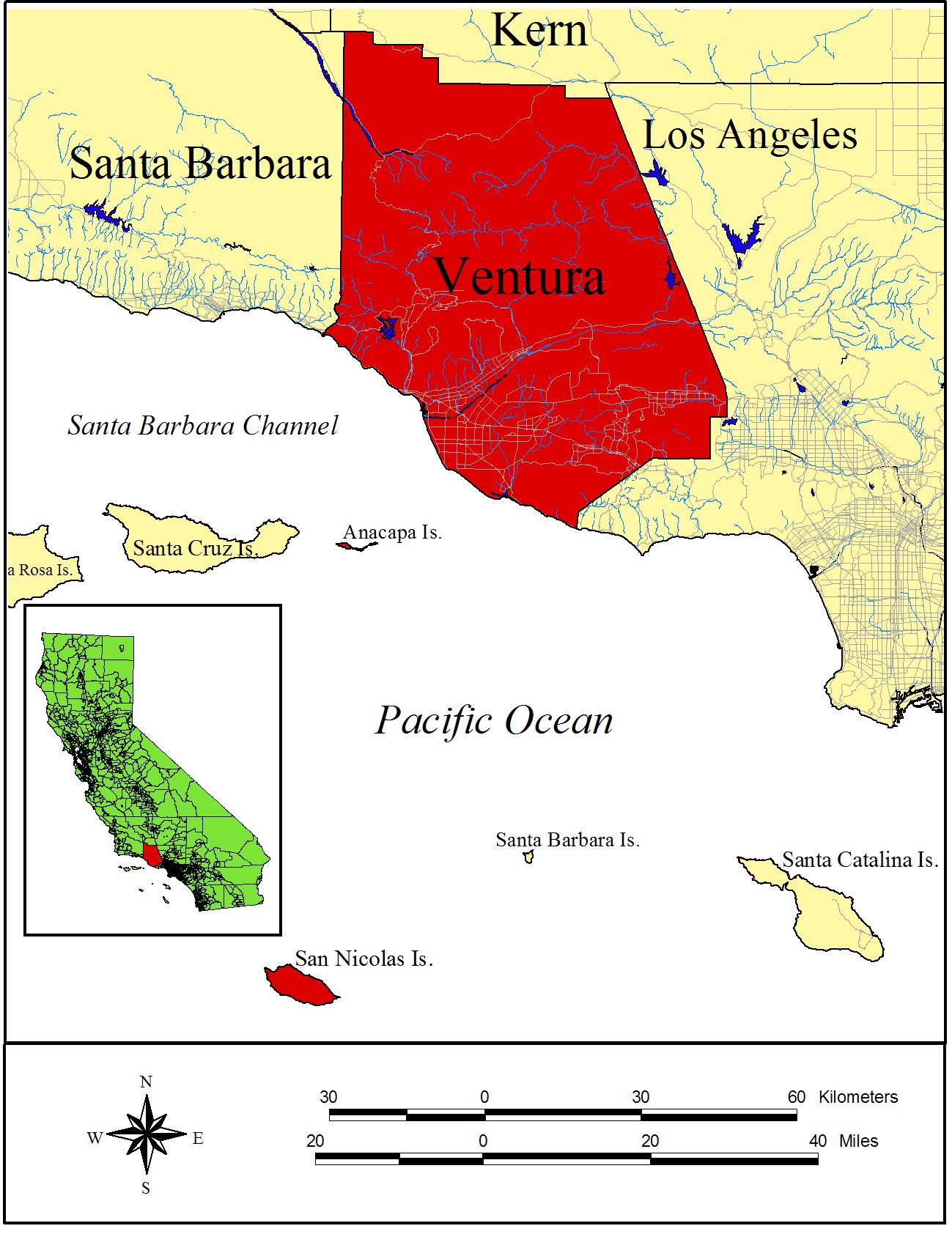

To download a map please enter the parcel number or map book number below to access to the map book for that parcel. Read the assessor parcel map instructions to learn how to decipher the parcel number (apn) and map book. The property tax system consists of several agencies all working together to provide funds for the county's expenses. Easily find the form you are looking for below or visit the boe forms website for all available boe forms. The county of ventura’s assessor’s office has sent out by mail approximately 250,000 assessed value notices to taxpayers of ventura county. I am honored and privileged to serve as your county assessor. Much of our data is supplied to you for your own research.

Siarly Leak: Prepare Yourself For The Shocking Truth

The Bronwin Aurora Leak: Impact And Aftermath

Gia Duddy's Private Life: A Will Levis Leak Nightmare