Dec 3, 2024 · compare fskax and fzrox based on historical performance, risk, expense ratio, dividends, sharpe ratio, and other vital indicators to decide which may better fit your portfolio. Fzrox has slightly performed better over its very short history than fskax. Also zero expense ratio cannot be beat. Fskax pays a higher dividend percentage and more often during a. Nov 15, 2019 · fzrox and fskax are both us tsm funds but follow different indexes.

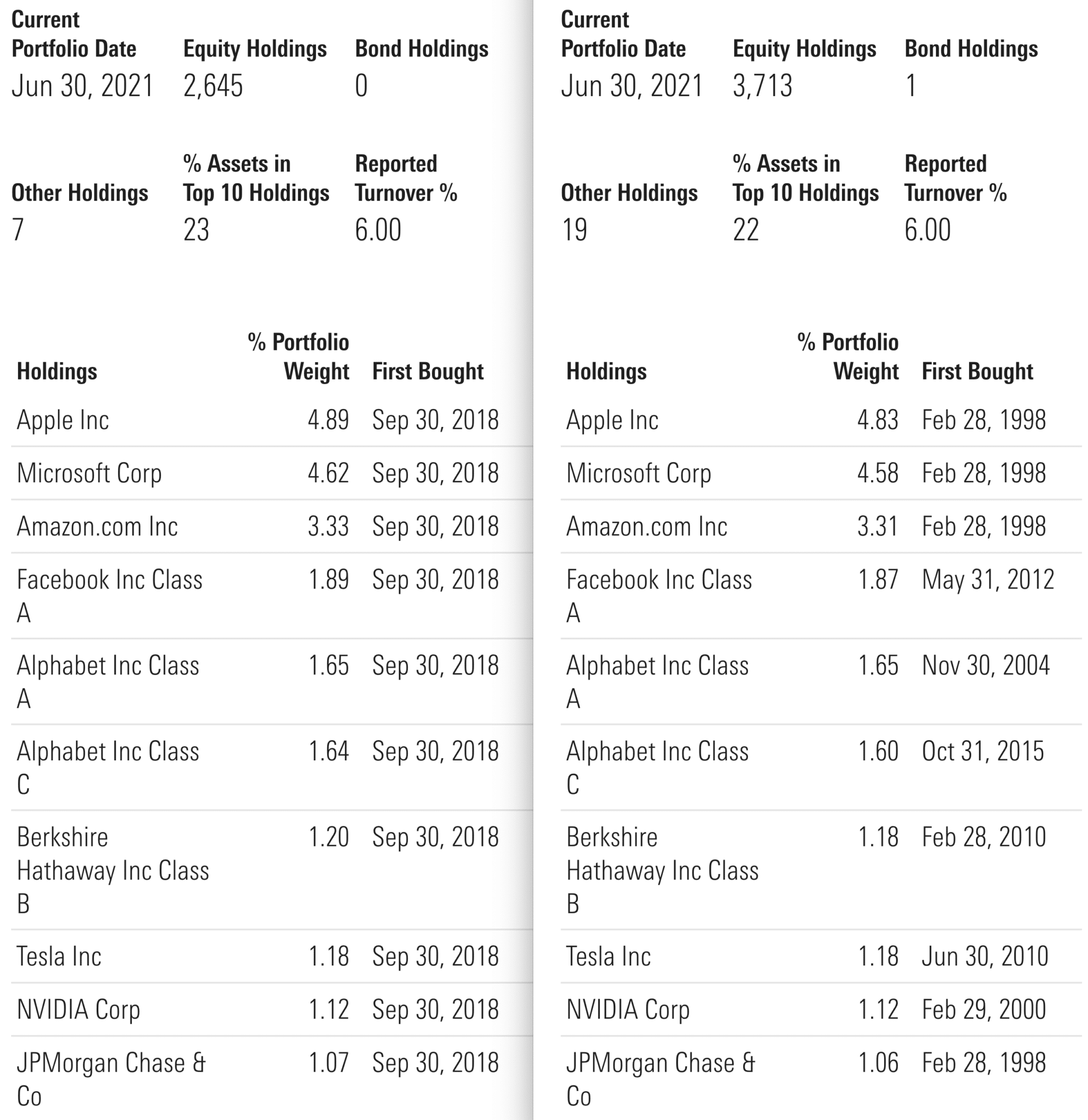

Fzrox has 2,503 holdings and fskax has 3,473 holdings. Both fzrox and fskax are excellent choices for building a 60/40 portfolio. If you’re sticking with fidelity, fzrox’s zero fees make it a compelling option. If you want the flexibility to move your. Mar 31, 2021 · fskax vs fzrox is essentially: Is it worth paying 0. 015% long term for a bit more on small caps. If large/mid cap outperforms small cap in our lifetime, then fzrox will be. A comparison between fskax and fzrox based on their expense ratio, growth, holdings and how well they match their benchmark performance.

Izzy Green Leak: Will This Change Everything?

The Skirby Tapes: The Bombshell Everyone Is Talking About

You Won't Believe What The Sofia Gomez Leak Reveals