At its core, naked puts entail selling put options sans a short position in the underlying asset, morphing into a potent play when maneuvered with insight. In this piece, we pull back the. Aka short put, selling to open a put; A naked put, also known as an uncovered put, is an options strategy where an investor sells put options without holding positions in the underlying security. This strategy is used when the.

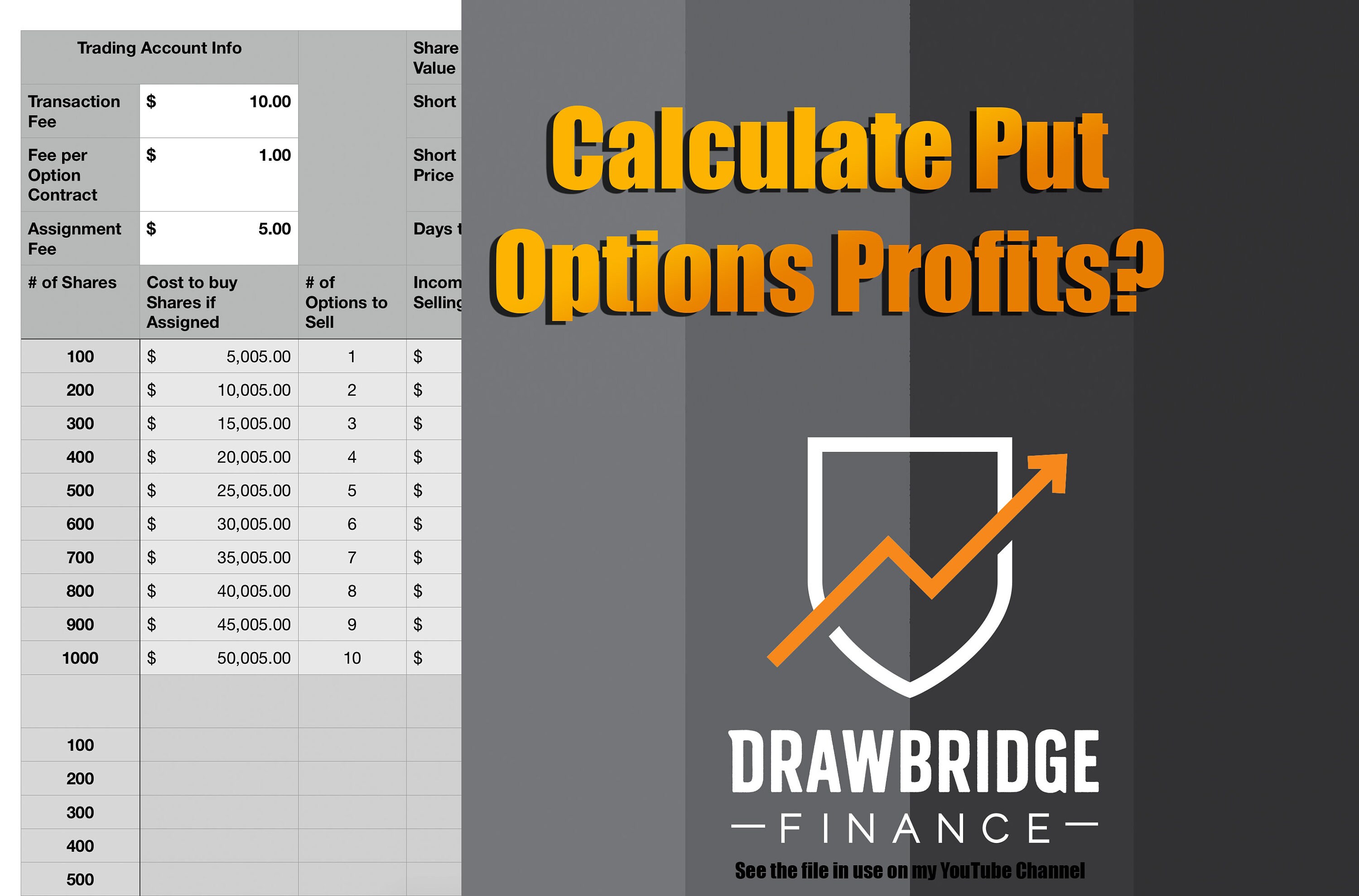

The current premiums are in the bid column. That's your maximum profit. The naked put option strategy is used to generate income on a security you may not own but could be forced to buy. Profit is limited to the premium received (net credit) for 100 contracts.

The Izzy Green Leak: Protecting Your Data In A Digital World

Camilla Araujo Fapello: Her Life In Pictures

From Top To Bottom: The InfluencersGoneWild Collapse