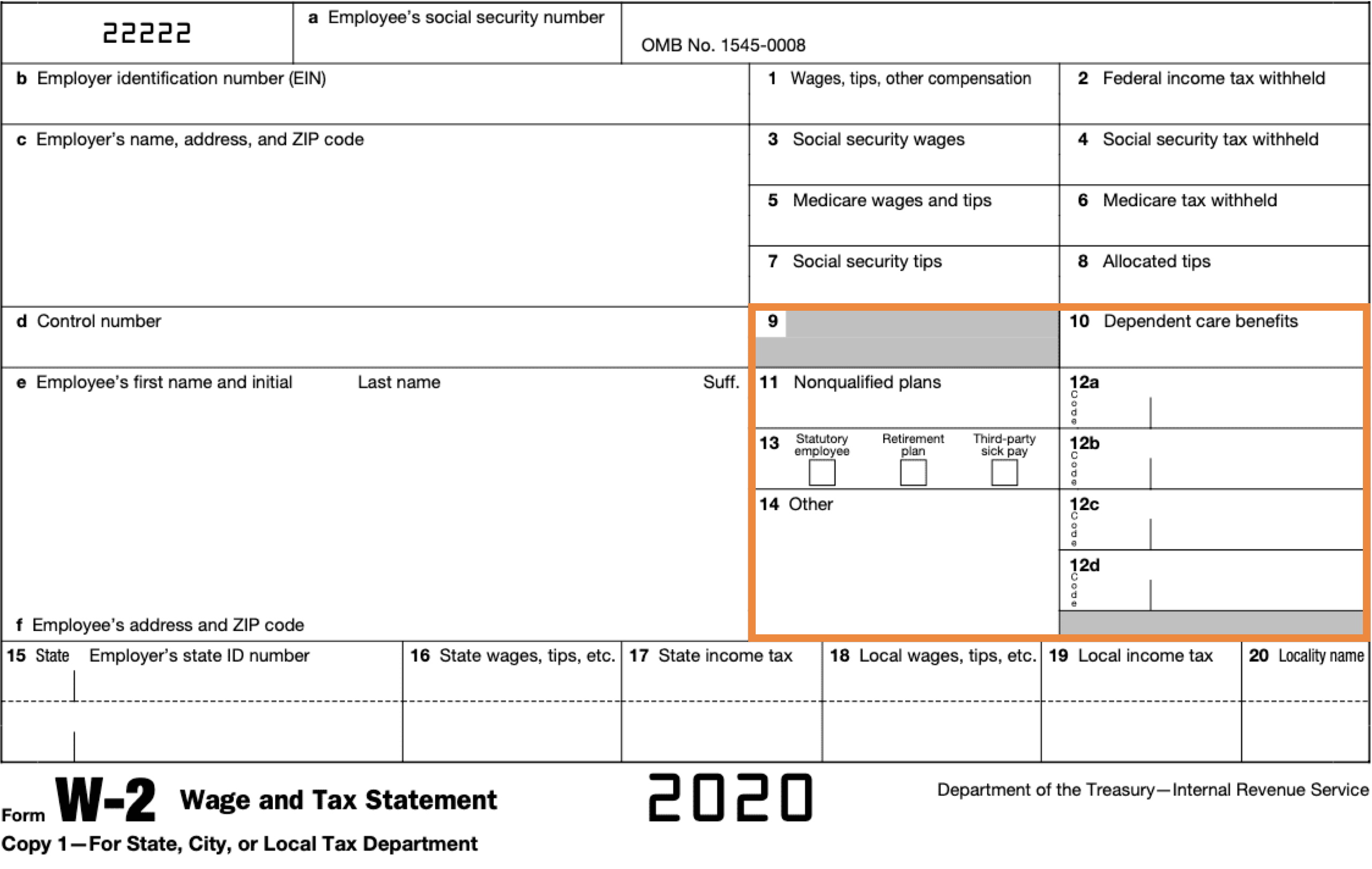

Jan 22, 2021 · s125 refers to a section 125 plan which describes payroll deductions for some employee benefit. Ret probably describes a contribution to a retirement plan. This doesn’t apply to section 125 contributions. If it is an employee benefit that has already been removed from wages in box 1 , then, choose a category of other. Apr 9, 2022 · sec 125 is your employer's benefit plan.

This can make it difficult to determine what the information entered in that box means.

Bronwin Aurora: The Leak That Rocked The World

Aubrey Keys OnlyFans: A Story Of Perseverance

Exposed: The Truth About ItsKensleyPope